Have you seen the grocery store signs that say, “Buy one, get one,” or “Buy one at $4.99, or get four for $2.99 each?” It’s a concept called “spaving,” a time-tested marketing strategy designed to get consumers to spend more–perhaps more than they wanted. Spaving plays on your emotions, designed to promote an impulse buy because even the most disciplined shopper may be unable to pass up a

deal. In some instances, the price-cutting promos work great for the consumer. But other times, “spending more money to save money” does not make sound financial sense.1

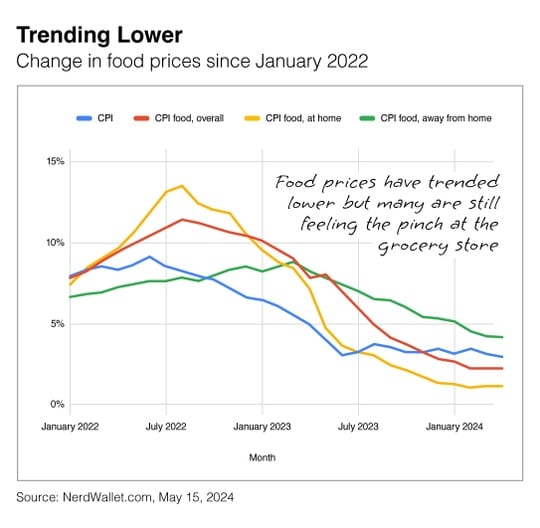

The accompanying chart shows that food prices have decreased since mid-2022 as companies have resolved food production costs, labor costs, and supply chain issues. The Consumer Price Index for “food at home” has been tracking right around 1% this year, but the recent price stability doesn’t offset the food inflation in 2021 and 2022.2

Other retailers are starting to feel the heat from bargain hunters, too. In recent weeks, Target, McDonald’s, and several others have cut prices as shoppers become more selective about spending as their budgets get squeezed.3

I’ve worked with several clients who were having trouble making ends meet. Some of them are retired and need to adjust to have more spending money. So, if you are feeling the pinch, please let me know. Sometimes, I’ve found that even the slightest change can make a big difference.

- FoxBusiness.com, May 19, 2024. “Finance expert sounds alarm over ‘spaving’ trend: An old ‘trap’ with a new name hitting your wallet.”

- NerdWallet.com, May 15, 2024. “Food Prices Stayed Flat in April. Groceries Actually Declined.”

- CNBC.com, May 22, 2024. “Why Target and McDonald’s are cutting prices and offering deals.

Source: Steve Lindquist – gbfinancial.org

Securities and advisory services through Cetera Advisor Networks LLC (doing insurance business in CA as CFGAN Insurance Agency LLC), member FINRA, SIPC, a broker/dealer and a registered investment adviser. Cetera is under separate ownership from any other named entity. CA Insurance License #0G30574

Investments are:

Not FDIC/NCUSIF Insured

- No Bank/Credit Union Guarantee

- May Lose Value

- Not a deposit

- Not insured by any federal government agency

Confidential: This email and any files transmitted with it are confidential and are intended solely for the use of the individual or entity to whom this email is addressed. If you are not one of the named recipient(s) or otherwise have reason to believe that you have received this message in error, please notify the sender and delete this message immediately from your computer. Any other use, retention, dissemination, forwarding, printing, or copying of this message is strictly prohibited.

Individuals affiliated with this broker/dealer firm are either Registered Representatives who offer only brokerage services and receive transaction-based compensation (commissions), Investment Adviser Representatives who offer only investment advisory services and receive fees based on assets, or both Registered Representatives and Investment Adviser Representatives, who can offer both types of services.